Let the Good Times Roll

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

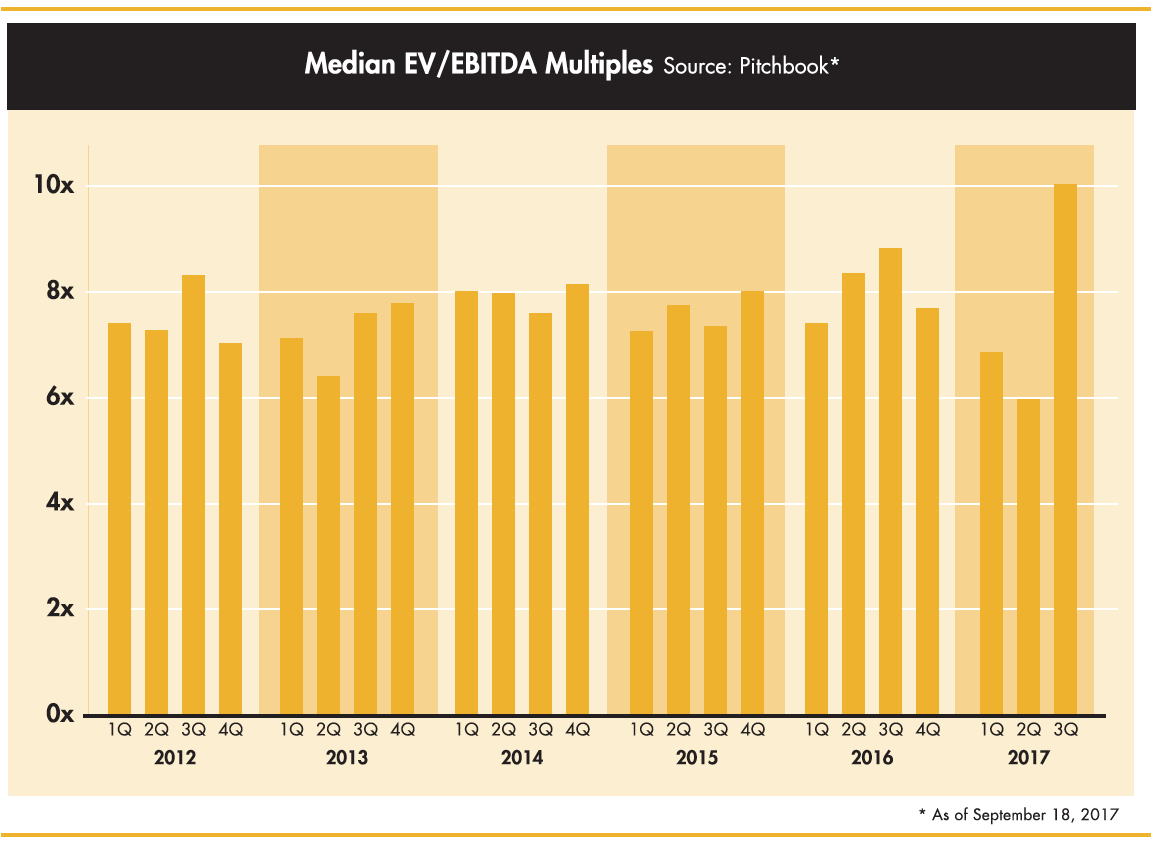

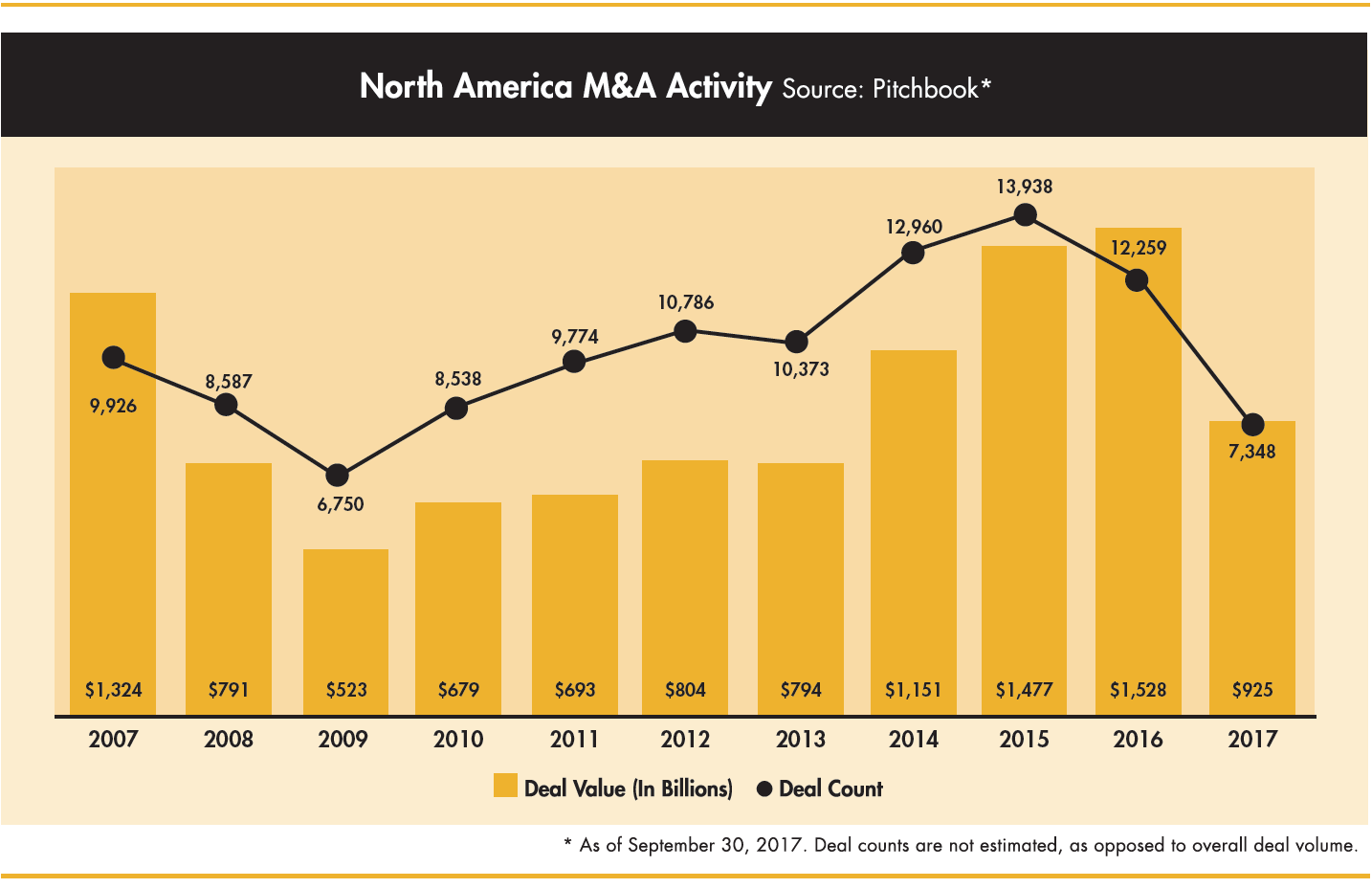

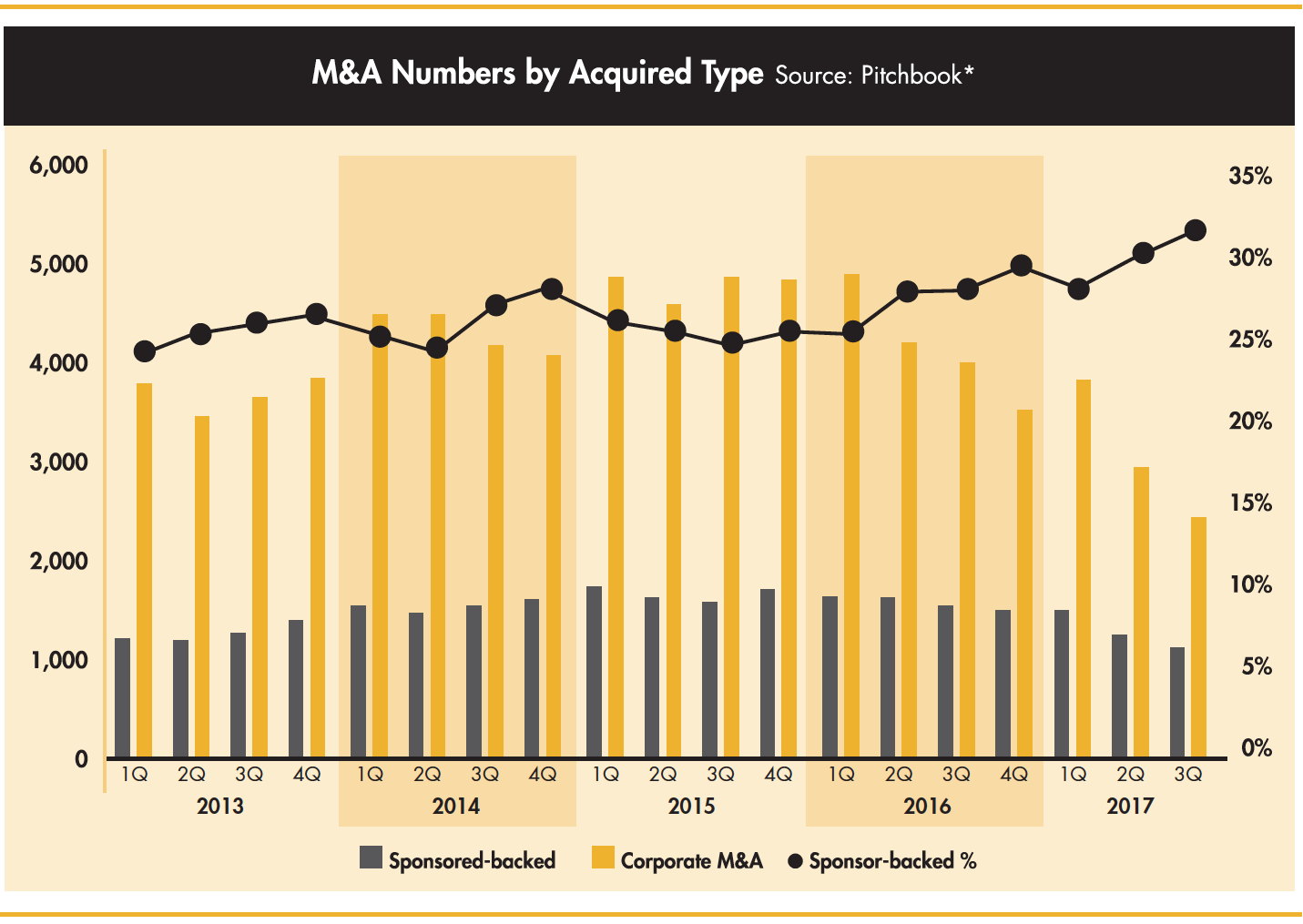

To say the third quarter was strong would be an understatement. With valuations and leverage levels at nearly all-time highs, it is clearly a seller’s market in the middle and lower-middle markets. In fact, according to Pitchbook, valuations reached their highest level on record during the quarter. These observations beg the question, “What’s driving the markets, and how long will it last?”

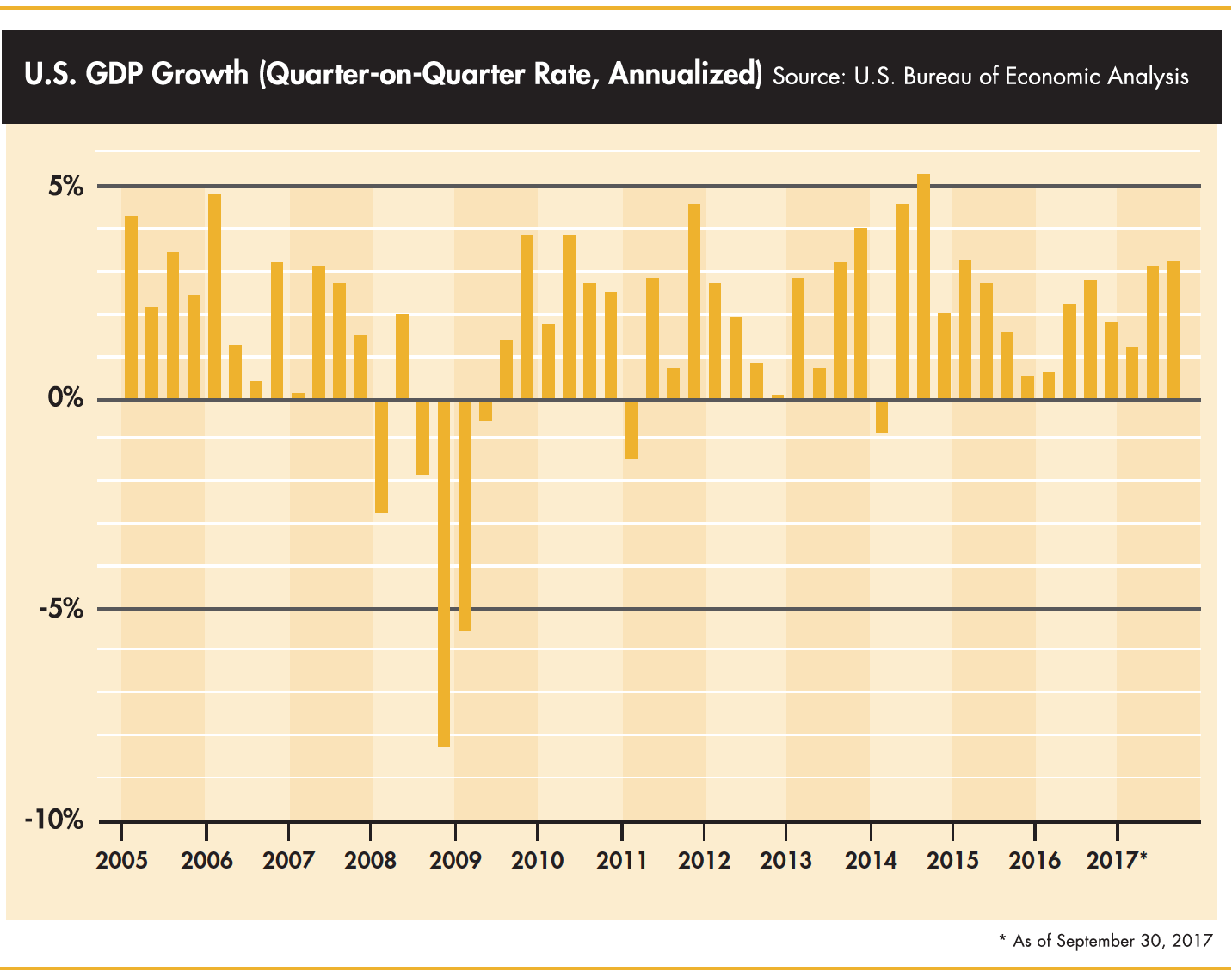

As everyone knows, financial and economic markets are cyclical. So the biggest question clients ask is, “What inning are we in?” There’s no way of knowing what inning it is, but we can suggest that we are in the second half. Economic cycles are typically 7-10 years, and depending on how one measures it, we are seven years into the current cycle.

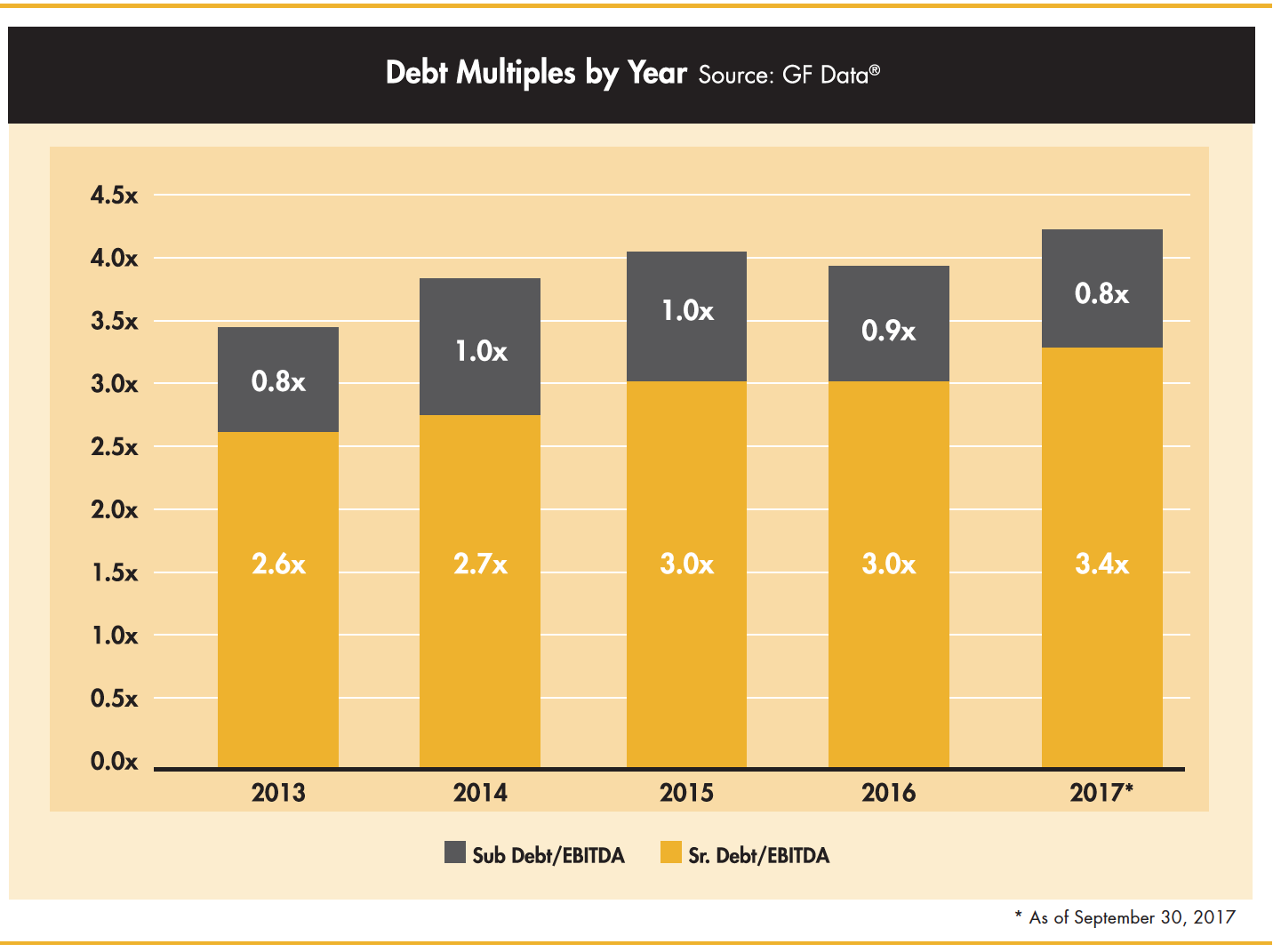

Sr. Debt/EBITDA lending ratios remain strong, and we are seven years into the current cycle.

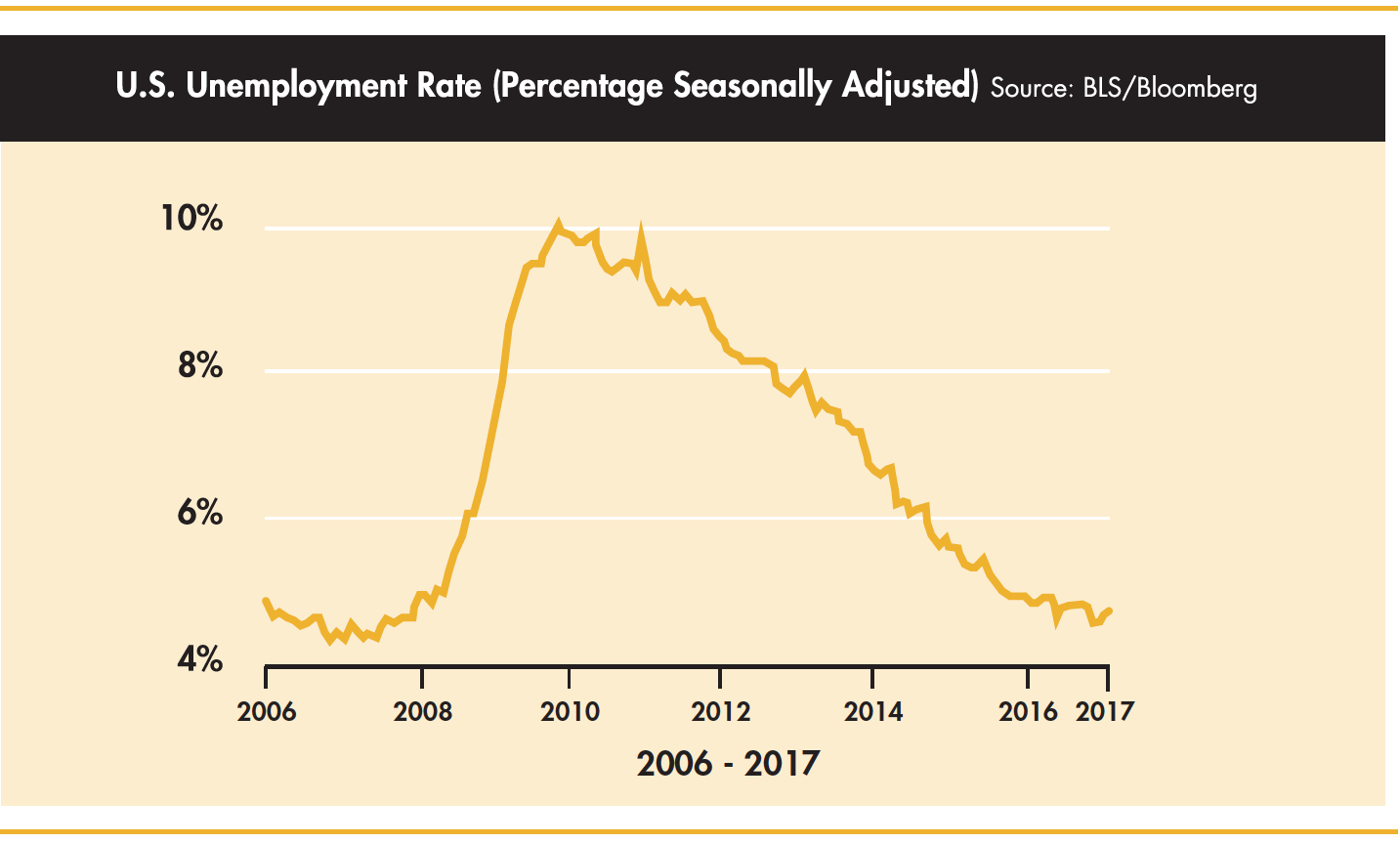

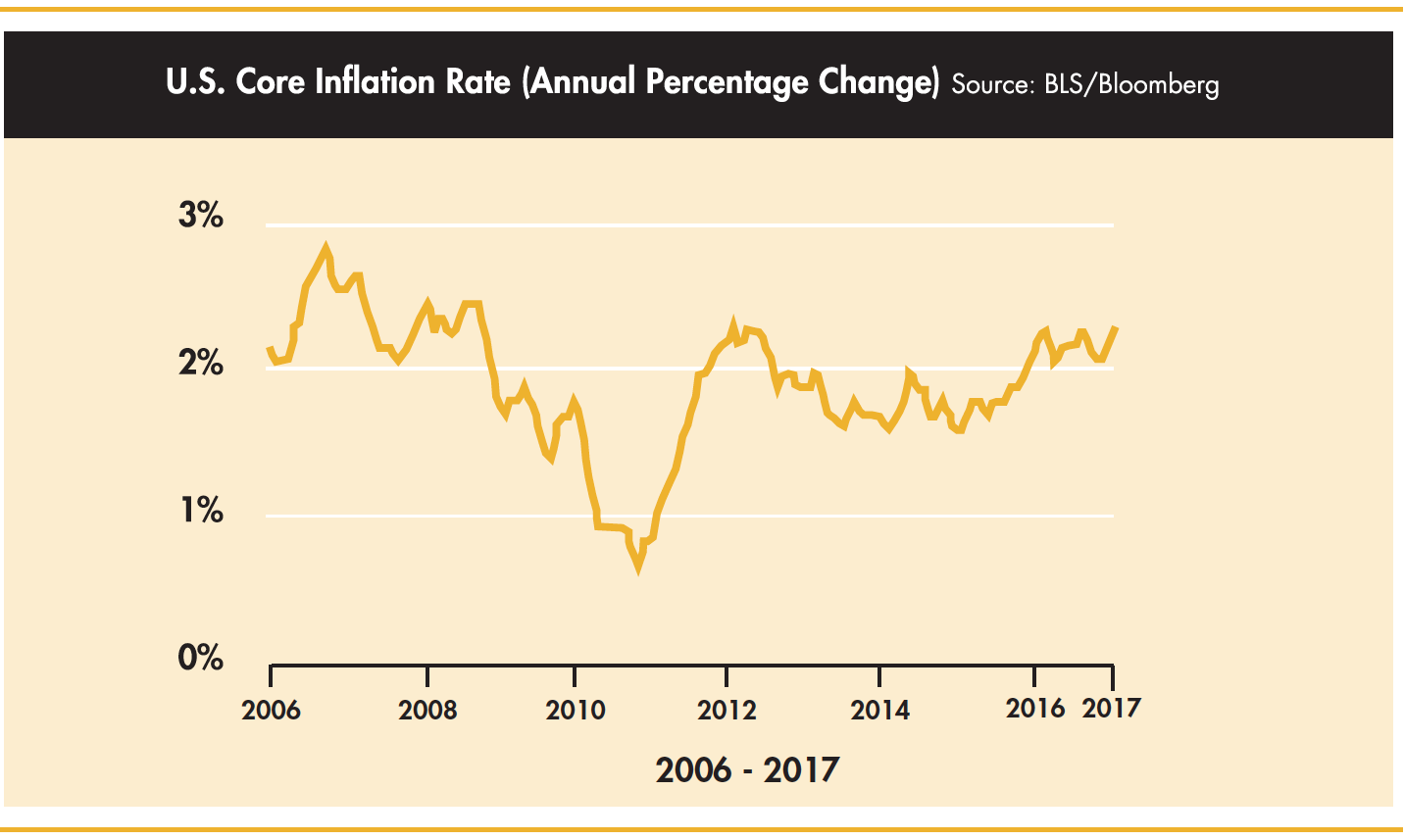

In terms of what’s driving the high valuations, yes, general macroeconomic conditions are, for the most part, favorable. Growth is good, inflation is low, and unemployment has dropped to favorable levels.

Unemployment and inflation are at favorable levels.

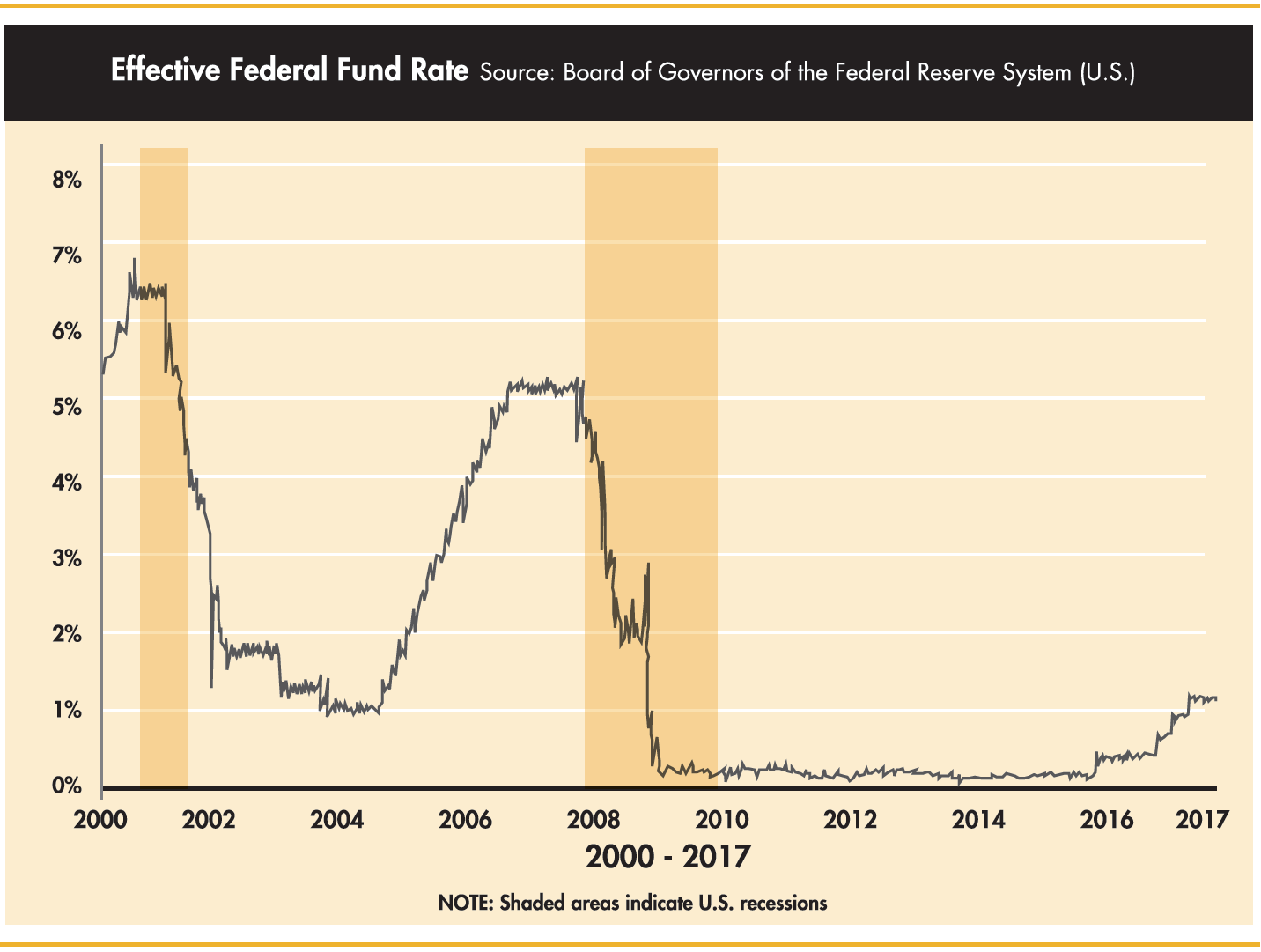

All these factors are contrasted against the backdrop of a continuing low interest rate environment. Yes, the Fed has been raising rates, but they continue to be low by historical standards, and debt spreads are also low, which makes borrowing costs attractive for companies and investors alike. In other words, growth is cheap, and leveraged buyout (LBO) models “sing.”

Supply and demand play a role in this historically high valuation environment.

Also, playing a role in the historically high valuation environment are supply and demand – the supply of attractive LBO candidates and the demand by private equity funds. However, demand does not come just from LBO firms, but also from newly aggressive family offices and highly valued strategic players as well.

Transaction volume remains strong through 3Q and into 4Q.

Our final observation is a bit more anecdotal. To be sure, buyers are willing to pay all-time-high multiples. But in return, buyers are demanding a relatively high standard of due diligence. Quality-of-earnings reports, once reserved for only very large targets or ones with complex financial reporting, are now fairly commonplace, even in the middle market.

For now, the good times are indeed rolling. (Not quite to the degree of cryptocurrencies, but we’ll save that discussion for another day.) Valuations are at nearly all-time highs. Leverage levels are back to almost 2007 levels. If you have a business you’ve considered selling, now is a great time to go to market. The current environment and outlook are both good, and you would not want to miss the right opportunity.

With all the current dynamics, it is more important than ever for sellers to be prepared when going to market. WCF stands ready to help maximize value for your business.

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. The content of this material was obtained from sources believed to be reliable, but neither Wipfli Corporate Finance Advisors, LLC nor RKCA, Inc., warrants the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice. This material should not be considered, construed or followed as investment, tax, accounting or legal ad vice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of Wipfli Corporate Finance Advisors, LLC or RKCA, Inc. Investing in the financial markets involves the risk of loss. Past performance is not indicative of future results.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.