Surveying the Value of Investment Bankers

Please be aware: More recent data has been published since the time of this post. To see current market trends, check out the most recent issues of Market Updates.

It’s not uncommon to encounter business owners who are selling their companies yet are hesitant to engage the help of investment bankers. Oftentimes those owners believe they can replicate the banker’s service without having to pay a fee.

In contrast, there are those owners who have engaged investment bankers to lead the sales process and found that the value they received from their advisors far outweighed the fees paid.

To be sure, there have been numerous studies that clearly bear out the value of investment banking services. One such study recently conducted by Fairfield University Dolan School of Business1 surveyed 85 companies that engaged investment bankers, selling their businesses for between $10 million and $250 million. In the study, all respondents acknowledged the value received from their advisors, with the vast majority stating that such value was significant.

What exactly are these advisory services, and why do owners who have successfully sold their businesses find them so valuable? The typical response is that investment bankers identify buyers and have relationships with those buyers. While this is true, there is substantially more to the value story than simply uniting a buyer with a seller.

A good investment banker will add significant value through strategy by positioning the opportunity to potential buyers, structuring the deal to extract the most value for the seller, and bringing disciplined project management to the transaction. All are very distinct skills and can take a great deal of time to execute—time most business owners cannot afford to devote to the sales process.

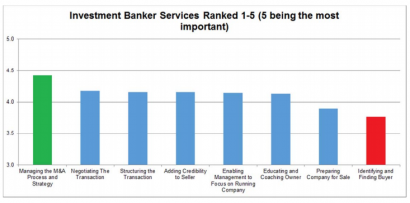

The following summarizes the typical services an investment banker provides, as defined by the university’s study, and presents them in the order of importance that the business owners placed on them during the survey.

Services and Their Importance

“Investment bankers level the playing field between experienced buyers and novice sellers in the M&A market in the same way that attorneys do in legal matters.” — Michael B. McDonald IV, Assistant Professor of Finance, Fairfield University

- Managing the M&A Process and Strategy. This was most important to the business owners surveyed. The investment banker’s service in organizing a go-to-market plan to conduct a competitive auction and the ability to execute that plan were crucial. The author further defines this service as an investment banker’s ability to create teasers and confidential memos, manage the data room, negotiate key terms and conditions, and manage the auction to a timeline whereby buyers can bid with confidence and enthusiasm.

- Negotiating the Transaction. Second in importance was the investment banker’s ability to negotiate letters of intent with credible prospective buyers and ensure that key terms matched the objectives of the owners, protecting them against future liability.

- Structuring the Transaction. The next most important service was designing a structure that maximized after-tax proceeds at closing (and potentially thereafter) while minimizing the seller’s risk.

- Adding Credibility to the Seller. Business owners believed that having an investment banker lead the process made buyers aware that theirs would be a competitive and reputable process. It further ensured buyers that the information they were viewing was accurate and that the seller was serious about a closing.

- Enabling Management to Focus on Running the Company During the Sales Process. By stressing the importance of this service, owners recognized the challenges of trying to run day-today operations while taking on a once-in-a-lifetime transaction.

- Educating and Coaching Owners. Another significant service on the list was the ability of the investment banker to advise owners on the overall sales process, timing expectations, valuation, negotiations strategy, and how to best articulate the opportunity—all valuable aspects of the engagement.

- Preparing the Company for Sale. Expectations for this service included working with owners and management to identify value drivers, address weaknesses, and implement changes, if necessary, to maximize value and ensure a closing.

- Identifying and Finding the Buyer. This is the most obvious of all of the most important services noted. It includes researching and using a firm’s network to identify and qualify buyers, connecting with the key contact within a buyer’s company, and succinctly conveying the primary strategic and financial incentive to the potential buyer.

Collectively, these eight services all added value for the owners, according to the survey. They can increase the probability of a closing, decrease the time to close, increase the value received by the seller, and improve the overall terms of a transaction. Also worth noting: Eighty-four percent of the owners surveyed said that the final sale price was equal to or higher than the initial sale price estimate provided by their investment banker.

The Value Is Clear

It never hurts to connect with an investment banker, especially if a sale is expected within the next two to five years. By doing so, you can vet the services above more thoroughly. In addition, a good investment banker will provide a roadmap to help better prepare your business for the sale.

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.