Bank Buy-Sell Agreements: What is Your Plan?

Poorly crafted, ill-conceived, outdated buy-sell agreements—or worse, no agreement at all or just “what we’ve always done”— offer endless examples of board members who’ve set themselves up.

Many banks and boards endlessly twist in the wind of litigation, as if a tornado has taken its toll, after a “triggering” event activates a poorly crafted, ill-conceived, or outdated buy-sell agreement.

Crafting a good buy-sell agreement is as much about protecting a board, its shareholders, and a bank’s legacy as it is about protecting wealth and maximizing shareholder value. The greatest wealth- creating generation, the Baby Boomers generation, is about to retire. How will they plan for their last “BIG” deal?

Buy-sell agreements govern how ownership will change hands if a significant or “triggering” event happens or how the board buys back shares. Triggering events can cause buy-sell agreements to be put into action. The intent is to ensure the board controls the outcome and direction during critical transitions. Buy-sell agreements can be between the shareholders and the bank, between the shareholders (cross-purchase agreement), or a cross between the two (hybrid agreement).

Buy-sell agreements should be designed to accomplish several objectives. They should define the conditions that “trigger” the buy- sell agreement, provide a market for shares, and establish a fair price as well as the terms so transactions can occur in an orderly and reasonable fashion. Buy-sell agreements should also specify financing (cash, life insurance, sinking fund, external borrowings, other) to acquire those shares (if applicable for large blocks of shares). Unfortunately, many buy-sell agreements don’t accomplish these objectives.

Pricing Mechanisms and Their Risks

Buy-sell agreements typically are constructed with one of three types of pricing mechanisms, each with its own set of challenges to be addressed.

- Fixed-price agreements. In this mechanism, the board agrees on a price and sets that price in the agreement. However, over time, that price becomes out of date and can be far higher or lower than the current realistic value today.

- Formula price agreements. In such agreements, the owners agree on a formula to calculate the price. Often, however, no one recalculates the formula to reflect current realities, and the original formula produces an unreasonable result. The formula price may be higher or lower than a realistic value today. In addition, the owners often haven’t agreed on how to make any necessary and appropriate adjustments.

- Valuation process agreements. With these agreements, the owners agree to bring in a business appraiser(s) to determine the price when the buy-sell agreement is triggered. In essence, no one knows what the “price” will be or what premises the definition of “value” that an appraiser will provide. Could the definition of value be book value, tangible book value, or something else? What methods or approaches will be used? Will discounts be taken or premiums given? What, if any adjustments, should be made? Have the parties determined the qualifications for the appraiser(s)?

In the end, will the value be reasonable or unreasonable given the board’s expectations? No one will know the outcome until the end of a lengthy, cumbersome, expensive, and uncertain process.

Stop the Ticking Time Bomb

The solution for averting disaster lies with the board. Rational conversations at the board or shareholder level regarding key aspects of the buy-sell agreement, although at times difficult, will lead to the best workable agreements. Questions that are relevant to the discussion include: What do you want the buy-sell agreement to accomplish for the bank and the shareholders? Who are the parties involved? When will the agreement come into play? How will it operate?

Review your buy-sell agreement from business, valuation, and legal perspectives. Having an agreed-upon value is recommended. If there has not been one in the last 12 months, establish a process for conducting an annual valuation. If there is no agreed-upon value, then a valuation must be performed. The time to act is now. Once a buy-sell agreement is triggered, it’s too late to “fix” any issues that surface. Everyone will be bound by the “words on the page.”

A key recommendation to consider is to have a valuation process agreement consisting of a single appraiser, selected now and valued now, as well as at a triggering event.

By naming the appraiser at the time of agreement, all parties have a voice in the decision and can sign off on the appraiser’s selection, no matter how difficult the process of reaching agreement might be. The selected appraiser then provides a baseline appraisal in draft form to all agreement parties so that everyone can provide comments for consideration before the report is finalized. Ideally, the selected appraiser will provide updated valuations for buy-sell agreement purposes every year or two thereafter.

The advantages of selecting an appraiser now and valuing now are many:

- The selected appraiser is viewed as independent. An independent appraiser acts as an advocate for his or her conclusion, not as an advocate of any of the parties involved.

- The appraiser’s valuation process is witnessed by all parties at the onset. The appraiser must interpret the “words on the pages” in conducting the initial appraisal. Any issues regarding lack of clarity of valuation-defining terms will be resolved at the onset.

- The appraiser’s conclusion is known at the onset and has established a baseline price for the agreement. Because the process is observed at the onset, all parties know what to expect should a triggering event occur.

- The selected appraiser remains independent with respect to process and renders future valuations consistent with terms of agreement and with prior reports. Subsequent appraisals, either annually or at trigger events, should be less time-consuming and expensive than other alternatives.

- The parties involved gain confidence in the process and will always know the current value for the buy-sell agreement (helpful for all-around planning).

- The appraiser’s knowledge of the bank and the industry will grow over time, enhancing confidence for all parties involved in the process. This also creates a means of maintaining pricing for other transactions, thereby enhancing “the market” for a bank’s shares.

Annually, the shareholders or board can set the bank’s value using the appraisal or an interim formula. However, if value has not been set within 12 to 18 months, and a triggering event occurs, the agreement should call for another valuation.

Begin Now With These Key Questions

- Do you have a buy-sell agreement? If not, get one started now! If so, what type of agreement is it? And how long ago was it written?

- Do you know what the buy-sell agreement says? There are defining elements that must be in every buy-sell agreement if the valuation process and, therefore, the agreement are to work! These elements include the standard of value, the level of value, the “as of” date, and the qualifications of appraisers.

Identify areas of concern in your buy-sell agreement. Understand formula agreements and fixed-price agreements. Learn how to “fix” out-of-date formulas or fixed prices in those agreements. Know the differences between single-appraiser process agreements and multiple-appraiser process agreements. Understand the defining elements that must be present regarding the valuation process. Identify the process by which most problems can be averted for your buy-sell agreement.

About the Author

Looking to be more acquisitive?

Having an acquisition plan is critical. Start yours now.

Get the checklist now

Categories

Read all Market Updates and Insights

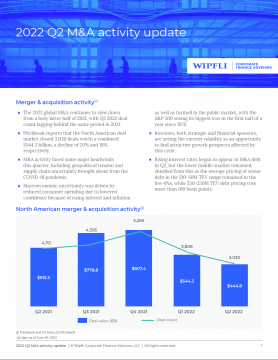

A quarterly, insightful look at middle-market merger and acquisition activity.

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.