WCF Advisors Blog

Category:

Market Insights

Thought-provoking articles on value, growth, and strategy, merger and acquisition news, research and analysis from WCF consultants.

How to Monetize Your Business Without a Complete Sale

Nov 08, 2017

|

Market Insights

Most business owners understand that an exit strategy should include maximizing their return on investment (ROI). Traditionally, business owners sought out two strategies to do this:

Developing a dividend stream (annual cash flow) that pays increasing amounts each year as the business grows

Selling 100% of the business and reaping the capital gains

However, more and more middle market companies are choosing a recapitalization path as a means to distribute cash to their owners without an...

What’s Your Company Worth? An Introduction to Advanced Planning for Business Owners

For many owners of closely held businesses, their business is their retirement plan — understandably, saving for retirement can often take a backseat to investing more capital in the business, and the proverbial retirement-planning can gets kicked further down the road.

Though an eventual sale of their business interest may provide a windfall large enough for long-term financial security, it’s still essential for business owners to understand the value of their company, now and in...

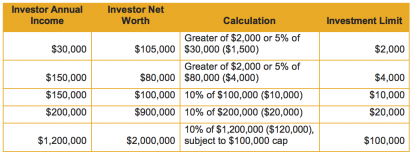

Crowdfunding for Capital? Know the Rules.

Consider the traditional approach to securing business financing: Armed with your valuable idea, a sound business plan, and some marketing research, you strive to get an audience with some wealthy investors, perhaps angel funds, a venture capital firm, and a few investment banks. You spend a great deal of time and effort pitching to this very limited pool of capital investors, with uncertain success.

Now consider a current popular approach called crowdfunding: You pitch your valuable idea...

Surveying the Value of Investment Bankers

Jan 01, 2017

|

Market Insights

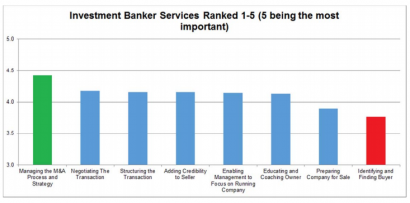

It’s not uncommon to encounter business owners who are selling their companies yet are hesitant to engage the help of investment bankers. Oftentimes those owners believe they can replicate the banker’s service without having to pay a fee.

In contrast, there are those owners who have engaged investment bankers to lead the sales process and found that the value they received from their advisors far outweighed the fees paid.

To be sure, there have been numerous studies that clearly bear...

Transition Service Agreements: Avoiding Pitfalls Along the Path to Divesture

Feb 01, 2014

|

Market Insights

Even the best tools can be obstructive if handled improperly, and in the world of divestitures, a Transition Service Agreement (TSA) is no different.

As legal agreements, TSAs are critical elements of divestitures. A TSA refers to a contractual arrangement between a buyer and a seller whereby the seller consents to furnish the buyer with certain services for a fee while the changeover is in progress. Ideally, this arrangement expedites the transition and ensures continuity by bridging a...

Recent Gift Tax Decisions: Favorable Impacts on Pass-Through Entities

Family limited partnerships (FLP) and limited liability companies (LLC) are routinely used for wealth preservation through asset protection and estate planning. FLPs can be an especially attractive planning option in that substantial valuation discounts such as discounts for lack of marketability and discounts for lack of control are common. This reduces the gross value of the estate for tax purposes, supporting wealth preservation and transfer tax savings.

The Internal Revenue Service continues...

Senior Debt: Strong, Steady, Bright

Jun 01, 2013

|

Market Insights

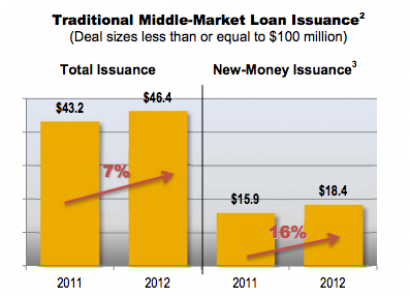

Today’s debt markets are healthier than they have been in a long while. Growth prospects are also stronger than they have been in some time. Combined, they’re proving to create a steady environment for middle markets.

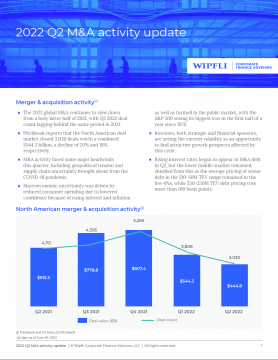

Global loan volume (middle-market and large capitalization companies) contracted 17% in 2012 to $3.1 trillion. Despite the contraction, it was still the second-highest total issuance since 2007. The primary reason for the decline in 2012 versus 2011 was that many...

Junior Capital: The Window Is Wide Open

Jun 01, 2013

|

Market Insights

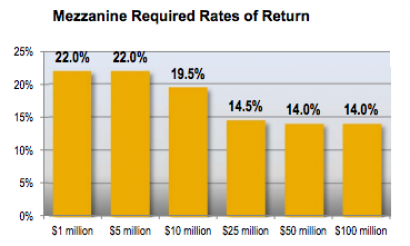

Junior third-party capital—either subordinated (also known as mezzanine) debt or institutional equity—can be useful to companies in a variety of ways. It can play an important part in creating value for existing shareholders, whether a company is looking to grow aggressively, its owners are seeking liquidity, or a company is pursuing a simple arbitrage scenario because of a low cost-of-capital environment. Here’s how junior capital provides benefits in each of these...

Bank and Holding Company Stock Buybacks: Being Vigilant About Value

We recently were the bearers of bad news to a bank client’s board of directors. We had to tell them that their stock, determined on a minority, nonmarketable basis, was not worth 160% of book value— the price at which they had been redeeming stock. “How,” they asked, “could our value decrease when we are still profitable and our book value has gone up?”

This is just one example of a bank or holding company using pre- recession multiples to buy back stock....

Post-Closing Disputes: Inevitable or Avoidable?

Dec 01, 2012

|

Market Insights

Too often the end of a difficult sale transaction doesn’t mean the end of the deal but rather the start of the next phase of negotiations with the buyer. Going through the sale process is a thorough journey for the seller, including working with the intermediary to prepare the marketing material, participating in management presentations, working through the chosen buyer’s due diligence, reading and understanding the definitive agreements, and preparing schedules for the definitive...